December 10th, 2025

Introduction

On November 28, 2025, CMHC announced changes in Advice No. 268 affecting documentation requirements, completion take-out financing, MLI Select energy efficiency criteria, and rental achievement holdbacks. Below is a summary of what’s changed, along with tables comparing the old and new requirements for each category.

CMHC advanced these changes with the purpose of clarifying its policies regarding completion take-out loans, as well as eligible loan purposes related to MLI Energy Efficiency and Rental Achievement Holdback criteria.

At 4Capital, we have outlined each of the changes with an explanation of the old and new rules, the reason for the changes, their implications, and advice on how to proceed this upcoming year.

Minimum Documentation Requirements

CMHC updated its minimum documentation requirements to streamline processes, reduce redundancy, and clarify lender responsibilities. The changes aim to make submissions more efficient by removing unnecessary universal requirements, such as photo documentation and blanket environmental confirmations, and replacing them with trigger-based requests that apply only when specific conditions exist. Critical items like equity and down payment proof have been moved upstream to ensure completeness early in the review process. Additionally, CMHC introduced enhanced lender accountability, requiring validation of asset values and portfolio metrics to strengthen risk assessment.

Conclusion

These revisions reflect CMHC’s broader effort to modernize its underwriting process and improve operational efficiency. By reducing redundant documentation and shifting toward conditional requirements, CMHC is attempting to accelerate review timelines and reduce back-and-forth requests. For borrowers and lenders alike, these changes mean clearer expectations, fewer surprises during underwriting, and a more predictable approval process. Overall, these updates focus on simplification, clarity, and consistency, while maintaining flexibility for follow-up requests when needed.

MLI Select Energy Efficiency

Overview

CMHC introduced significant changes to its Multi-Unit Mortgage Loan Insurance (MLI) Select program for new construction projects. The program now benchmarks energy efficiency performance against the National Energy Code of Canada for Buildings (NECB) and the National Building Code (NBC) 2020 instead of NECB/NBC 2017, aligning with other CMHC programs such as the Apartment Construction Loan Program (ACLP) and the Affordable Housing Fund.

A transition period is in place until September 30, 2026, offering flexibility for projects already in advanced design stages.

Definitions: Part 3 Vs. Part 9 Buildings

In addition to these changes, MLI Energy Efficiency is now making a distinction between part 3 and part 9 building categories, reflecting separate requirements for each. We have outlined the definitions for both categories for clarification:

-

- Part 3 (NECB): Large buildings, typically over 600 m² (~6,500 sqft Gross Floor Area) or more than three storeys, governed by the National Energy Code for Buildings (NECB). These include mid-rise and high-rise apartments, commercial, and institutional structures.

- Part 9 (NBC): Smaller residential buildings, generally three storeys or less and under 600 m² (~6,500 sqft Gross Floor Area), governed by the National Building Code (NBC). These include single-family homes, townhouses, and low-rise apartments.

MLI Energy Efficiency: Old Vs. New Criteria

Implications

From an operational perspective, developers may face significantly higher costs and greater complexity compared to previous standards. Achieving 50 points (Level 3) is now significantly harder, especially for NBC projects, which may require near net-zero design.

New Building Codes

-

- Stricter Base Code: NECB/NBC 2020 itself is more demanding than NECB/NBC 2017, with higher base standards to meet the Tier 1 requirements.

- Higher Improvement Percentage: On top of the stricter base code, the percentage improvement required for certification or incentive programs has also increased, making the requirements even more demanding.

Part 3 Vs. Part 9 Energy Requirements

Budget Implications

Energy modelers note that air-source heat pumps and electric DHW heaters – which previously contributed significantly toward Level 3 points – may now only yield 20 points under the new percentages. Insulation remains important, but due to the law of diminishing returns, each additional layer delivers smaller efficiency gains while marginal costs rise sharply. What was once enough to meet top-tier requirements can no longer efficiently achieve today’s higher standards on its own. Even technologies that once provided a strong boost now contribute only marginal improvements under the new standards.

Recommendations

From a financing perspective, these changes will impact leverage and equity requirements. Developers aiming for maximum MLI Select points must budget for higher upfront costs and may face tighter LTC ratios if energy upgrades push total project costs upward.

To ensure budgets are optimized and cost overruns are minimized, developers must move beyond single-solution strategies and adopt a diversified approach to meet performance targets. Insulation alone is no longer sufficient due to diminishing returns, so combining multiple measures is critical for cost-effective compliance. This may include:

-

- exterior insulation upgrades,

- airtightness testing,

- air-source heat pumps,

- Electric domestic hot water (DHW) heaters,

- and in some cases, solar panels and geothermal systems

Since the optimal strategy will vary by project, it has become more important to evaluate and

consider other MLI Select point categories alongside energy efficiency to determine which combination delivers the greatest benefit with the least complexity. In other words, a project that previously achieved Level 3 (50 points) through Energy Efficiency alone may now face significantly higher costs with the newer standards, making a combined approach across multiple categories such as Accessibility or Affordability a smarter and more practical solution to achieving the desired MLI points.

Given these implications, we strongly recommend that clients review their current pipeline and consider accelerating applications before September 30, 2026 to take advantage of the existing standards.

Conclusion

Although the overall cost of achieving higher levels has undeniably increased, developers can still manage the scale of that increase through strategic planning. The focus will no longer be on a base solution or a few measures; instead, success will depend on designing the most cost-efficient mix of measures to maximize performance while minimizing marginal costs. This requires a shift toward careful coordination, strategic planning, and thoughtful selection of upgrades.

Rental Achievement Holdbacks

Overview

Following the updates introduced in Advice 263 in July 2025 regarding Rental Achievement

Holdbacks (RAH) for the MLI Market Rental product, CMHC is enhancing the clarity,

consistency, and predictability of RAHs on all new constructions while balancing the need to

support rental housing supply with effective risk mitigation for loans that carry higher rentup

risk.

Advice 263 previously stated that rental achievement holdbacks would no longer be a policy

requirement for multi-unit loan applications under the MLI Market Rental product. As a

result, loans could be advanced up to 85% of LTC or LTV (whichever is less) without requiring

a rental achievement holdback:

Rental achievement holdbacks will no longer be a policy requirement for MU loan applications submitted under the MLI Market Rental product. Therefore, loans can be advanced up to 85% of the loan-to-cost/loan-to-value (whichever is less) without the need for a rental achievement holdback. This change applies to all loan purposes under the MLI Market Rental product

The intent was to simplify the process and support rental housing supply. However, there were no clear national thresholds on when a holdback applied or how to calculate it. Some lenders held back 75-85% LTC, others to 90%, and some did not hold back at all.

Advice 268 has now clarified and standardized the approach. It introduces clear national thresholds and provides specific examples of when holdbacks apply, ensuring consistency and predictability across all new construction loans.

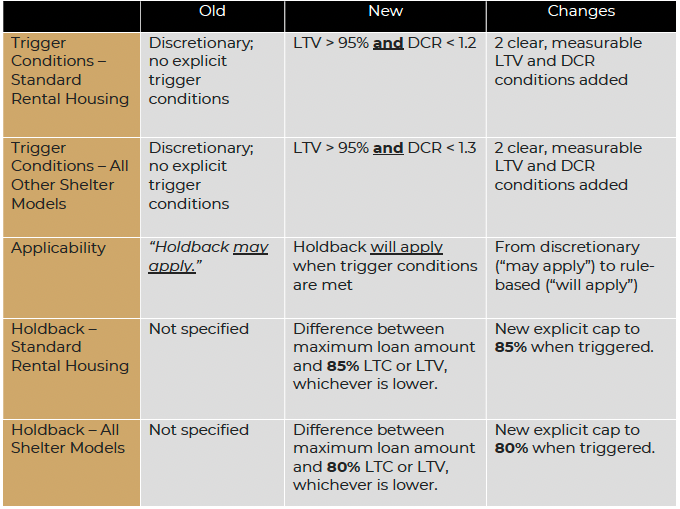

The following changes can be seen below:

Old Vs. New Rental Achievement Holdback

We would like to clarify the trigger conditions for Rental Achievement Holdback (RAH), as there has been a widespread misunderstanding in the industry. A common misconception is that the holdback will apply if either condition is met. This is incorrect; Advice 268 categorically states that RAH on Standard Rental Housing is triggered only when both conditions are satisfied: an LTV greater than 95% and DCR less than 1.2.

Another misconception is that the LTV threshold begins at 95%. This is also incorrect – the condition applies only when LTV exceeds 95%. An LTV of exactly 95% does not meet the requirement. Therefore, if a loan has an LTV of 95% and a DSCR below 1.2, the RAH will not be triggered.

Understanding CMHC’s Position

From CMHC’s perspective, the new policy does not actively discourage loans up to 95% LTV, because the trigger is set so high that almost no project will meet both conditions. In fact, the removal of discretionary RAH conditions could be interpreted as implicitly allowing, or even encouraging high leverage, so long as the Debt Coverage Ratio (DCR) remains within limits. This reinforces the notion that CMHC’s primary concern is rent-up risk, not leverage itself. Their goal is to avoid over-advancing funds on projects that cannot support debt service during lease-up. Put simply, CMHC is introducing a safeguard to remove outliers with extreme leverage and rentup risk, while still supporting rental housing supply.

Implications

The introduction of standardized Rental Achievement Holdback (RAH) rules brings several positive outcomes. It is predictable and consistent across Canada, eliminating lender-by-lender interpretation and uncertainty. Additionally, the new framework incentivizes borrowers to design projects with stronger debt service coverage ratios (DSCR) and more balanced suite mixes, while encouraging developers to adopt more strategic lease-up planning.

However, these changes also present challenges. An RAH trigger will reduce first-draw leverage, meaning borrowers will require more cash during construction, increasing upfront capital demands. Equity may remain tied up until the property reaches stabilization, delaying full equity recapture. In some cases, loan proceeds may not fully cover construction costs unless budgets are carefully optimized. Furthermore, seniors and supportive housing projects face added pressure due to the stricter DSCR requirement of 1.30, which could impact feasibility for these specialized developments.

In practice though, the 95% LTV threshold is rarely exceeded, as most developers avoid structuring projects at this level of leverage. The key factor that prevents most projects from triggering this requirement is the LTV condition; an exact 95% LTV does not qualify, and exceeding it is highly uncommon. Developers typically avoid building into a loss, and most lenders will not finance construction at leverage above 95%, as insurance premiums would push the effective charge against the property well beyond 100% LTV, sometimes reaching 105% or more. To illustrate the practical application of RAH holdbacks and the new changes, we created the following case study.

CASE STUDY: RENTAL ACHIEVEMENT HOLDBACKS

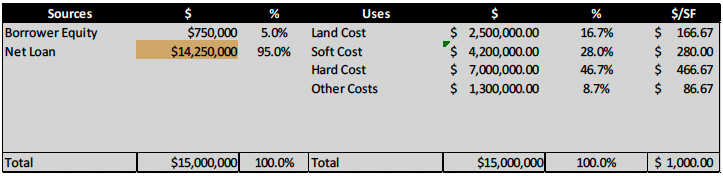

Prior to Advice 268, it was unclear whether the property would be subject to RAH. If it was subject to holdbacks, the LTV/LTC would be capped at 75%, requiring much more equity.

SCENARIO 2 – 98.1% LTV (AFTER ADVICE 268)

If we return to scenario 1 – where the DCR = 1.2 and the LTC = 95%, there will certainly be no RAH.

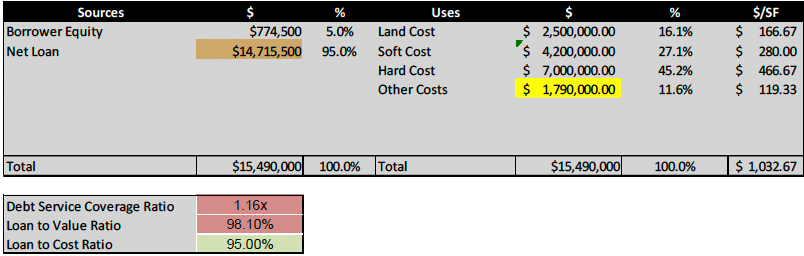

However, let’s assume that our costs increased for the project. The max LTC/LTV (whichever is lower) will have to be at the 95% LTC mark. We’re now borrowing above the as-complete project’s value of $15,000,000. The new values for the project are as follows:

Notice how the DCR fell below the minimum threshold due to the higher loan amount, causing the RAH to trigger:

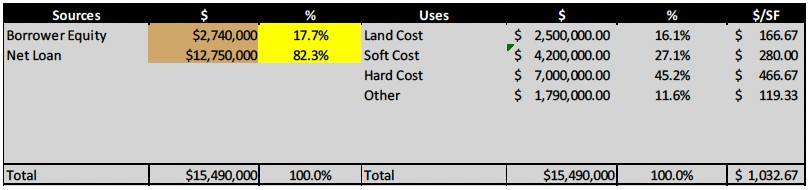

SCENARIO 2 – 98.1% LTV WITH RAH (AFTER ADVICE 268)

If we still try to achieve 95% LTC to minimize equity requirements despite the cost increases (highlighted in yellow), we will have an LTV=98.1% and a DCR=1.16x.

Notice how the DCR fell below the minimum threshold due to the higher loan amount, causing the RAH to trigger:

Recommendations

First, we recommend switching HST remittances to a monthly or quarterly schedule. This adjustment allows developers to capture refunds earlier, improving cash flow during critical draw periods. By accelerating these inflows, projects can offset the impact of delayed loan advances caused by holdbacks.

Second, we explore top-up financing options such as mezzanine financing, HELOCs, or second mortgages to cover any shortfall. Using a HELOC is particularly effective because it retains personal net worth (PNW) without negatively impacting the financing gap.

Additionally, we will work to maximize CMHC’s lending value through thorough underwriting and due diligence, ensuring CMHC’s value trumps the appraised value wherever possible to minimize or avoid holdbacks altogether.

Conclusion

The new RAH conditions are an overall positive change from a client’s perspective. It limits potential holdbacks through clear criteria and makes it very difficult to trigger a holdback. Clients can be assured that no holdbacks occur on their application and can plan their capital stack accordingly.

Conclusion

For documentation, we recommend clients continue obtaining Phase 1 ESAs immediately during due diligence to avoid delays and identify potential Phase 2 requirements early.

For energy efficiency, developers should engage consultants early and consider a diversified approach – combining insulation, airtightness, heat pumps, and possibly geothermal – while also leveraging other MLI Select categories such as affordability or accessibility to optimize points cost-effectively.

For rental achievement holdbacks, clients can take comfort in the fact that the new criteria make holdbacks highly unlikely for most projects, provided leverage remains at or below 95% and DSCR is maintained.

Overall, these changes create more predictability and transparency, and proactive planning will ensure clients maximize benefits under the new framework.